Why Historical Data Still Matters in Modern Investing

Historical data isn’t a map of the future—it’s the quiet memory of the market.

There are mornings when I wake with the faint sense that everything I’ve learned has been borrowed from the shadows of what once was. Perhaps that is why I’ve always found comfort in historical data, even as the world tries to convince us that only the future matters. My son, at twenty-two, still carries that bright hunger for what lies ahead, the belief that the unknown is where all the answers wait. And sometimes I envy him for it. The other day he asked me—genuinely, earnestly—how anyone could trust a portfolio built on the past when the future refuses to reveal itself.

I could hear the worry tucked beneath the question. That quiet fear that maybe the numbers don’t know as much as we hope they do.

But the truth I’ve come to understand is simpler:

we don’t look to historical data to predict the future; we look to it to understand the present.

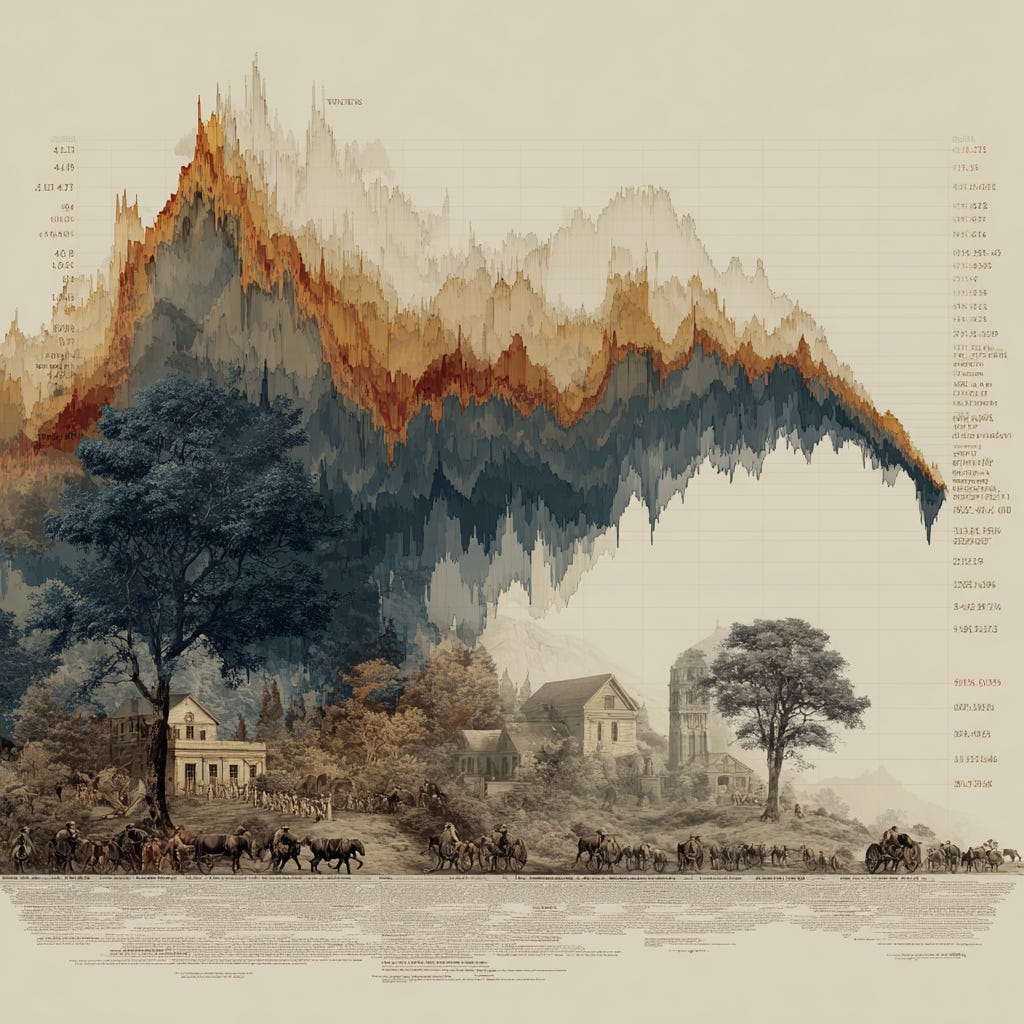

There is something grounding in tracing the arc of a stock’s performance over years, watching how it breathes—how it rises, how it falters, how it learns to stand again. Companies have tempers, rhythms, heartbreaks. And the market records every one of them. It’s not prophecy; it’s memory. And memory matters.

When I measure the five-year total return of a company, or when I walk through those rolling one-year windows, I’m not searching for certainty. I’m searching for character. I’m trying to feel the weight of a company’s journey—how it behaves when the world stumbles, how it recovers, whether it honors its own momentum. Because in those patterns, however imperfect, there is a kind of truth. Not the kind that tells you what tomorrow will bring, but the kind that tells you who you’re walking into tomorrow with.

I told my son that investing isn’t about guessing the future. It’s about choosing the companions you trust to travel with you. The companies that have shown, in the long and quiet accumulation of days, that they know how to move forward. Even slowly. Even unevenly. But always forward.

Historical data reveals that.

It shows the steadiness beneath the volatility, the growth beneath the noise.

And sometimes it shows the opposite—the companies that burn bright only to collapse under the weight of their own flash. We learn from that too. Loss is a teacher with a sharp tongue, but a good one. If I’ve grown wiser at all over the last thirty years of investing, it is because I’ve learned to listen carefully to what the past whispers before I run toward the promises of the future.

What I want readers—and my children—to understand is that investing is an act of humility. We cannot know. We cannot control. We cannot demand returns simply because we desire them. But we can observe. We can measure. We can pay attention to the quiet, steady signals the market gives us if we’re patient enough to see them.

Historical data is one of those signals.

A record of storms weathered.

A testament to resilience.

A mirror that reflects not just what companies have been, but who they are becoming.

That is why it still matters.

And why it will always matter, even as algorithms advance and markets shift and we continue pretending we can see farther ahead than those who came before us.

In the end, the past does not chains us—it steadies us.

And sometimes, that small steadiness is all we need to take the next step.