Long-Term Transits Reflect a Long-Term Edge

When the Outer Planets Agree with the Fundamentals

As of September 22, 2025, the outer planetary placements are particularly aligned with the structural themes embedded within the Lunar Landing Portfolio. Pluto—now retrograde at 1° Aquarius—continues its slow ingress into a sign it will inhabit until the early 2040s. Aquarius rules technology, systems, and collective innovation, echoing the portfolio’s heavy weighting in future-facing names like NVIDIA, Howmet Aerospace, and T-Mobile. Uranus, having recently entered Gemini (1°21′), signals a long-term awakening in communication systems, AI, and decentralized networks—aligning well with holdings in semiconductors, telecom, and logistics.

Neptune, retrograde at 0°47′ Aries, has just begun its multi-year cycle in a sign known for trailblazing and assertion. This supports speculative but visionary sectors like biotech (Vertex) and aerospace (Axon, Howmet), where breakthroughs require both courage and creative risk. Meanwhile, Saturn at 28° Pisces is closing a cycle marked by dissolution of rigid systems and the rise of soft-power structures—a backdrop favorable to companies that bridge technology and service, like Axon and McKesson. These planetary shifts—each governing eras that span 7 to 20 years—mirror the portfolio’s design ethos: investing not just in quarterly performance, but in companies positioned to thrive across generational change.

The Lunar Landing Portfolio is a curated basket of 15 high-conviction U.S. equities chosen for their alignment with secular growth trends, robust fundamentals, and technical strength. This group is designed to represent a blend of innovation-driven, quality-growth, and resilient infrastructure plays — names that tend to surge under favorable astrological transits and macro tailwinds.

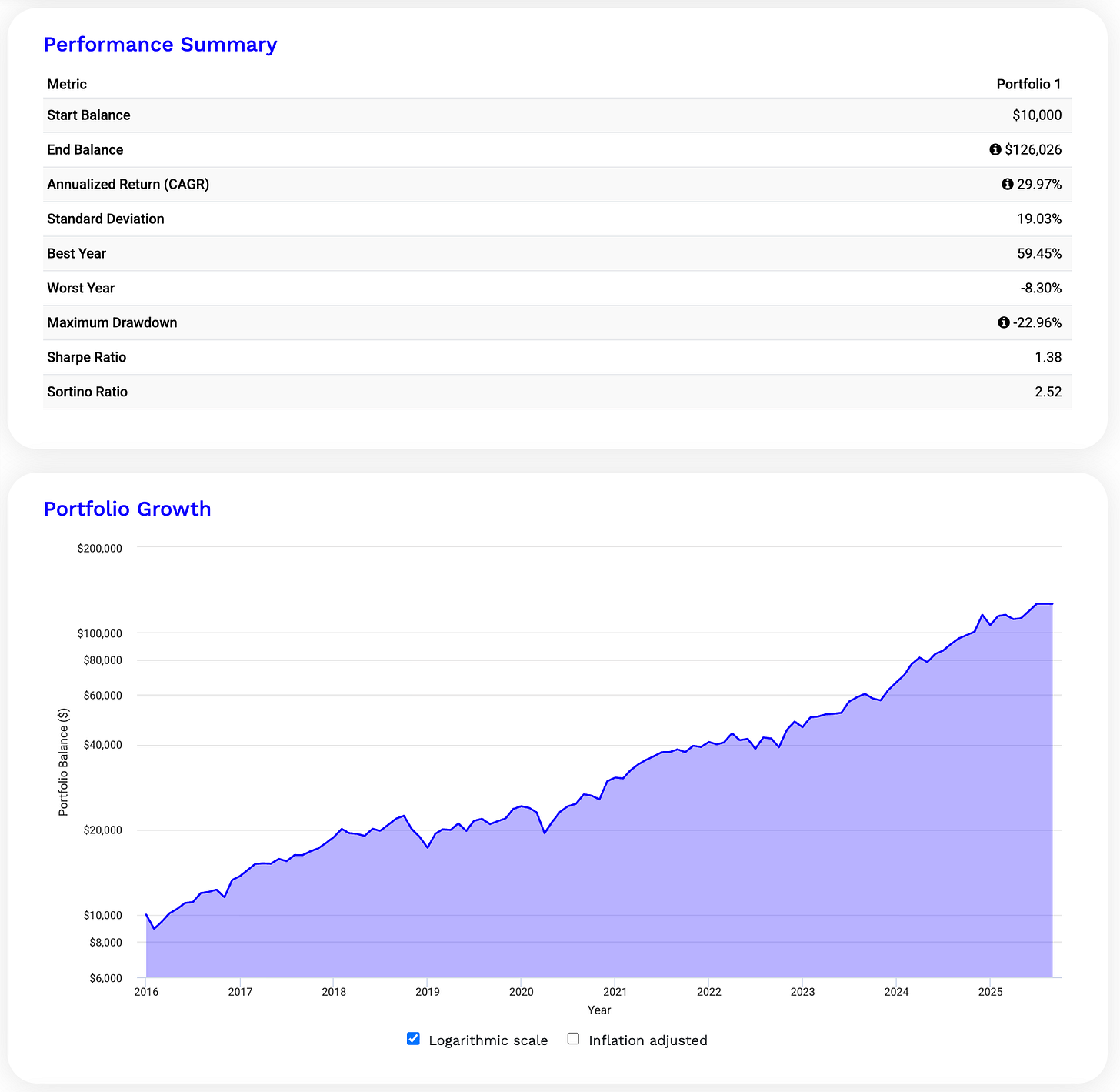

Over the trailing period from January 2016 through August 2025, the portfolio delivered an astounding 1,160% total return, compounding at an annualized rate of 29.97%. That growth transformed an initial $10,000 investment into $126,026. With 70% of months in positive territory and a Sharpe ratio of 1.38, the portfolio exemplifies disciplined construction, balanced risk, and the power of staying aligned with both structural trends and cyclical timing.