Libra, Pluto & Profit—The Astrological Alpha

Systemic Truth, Sector Strength

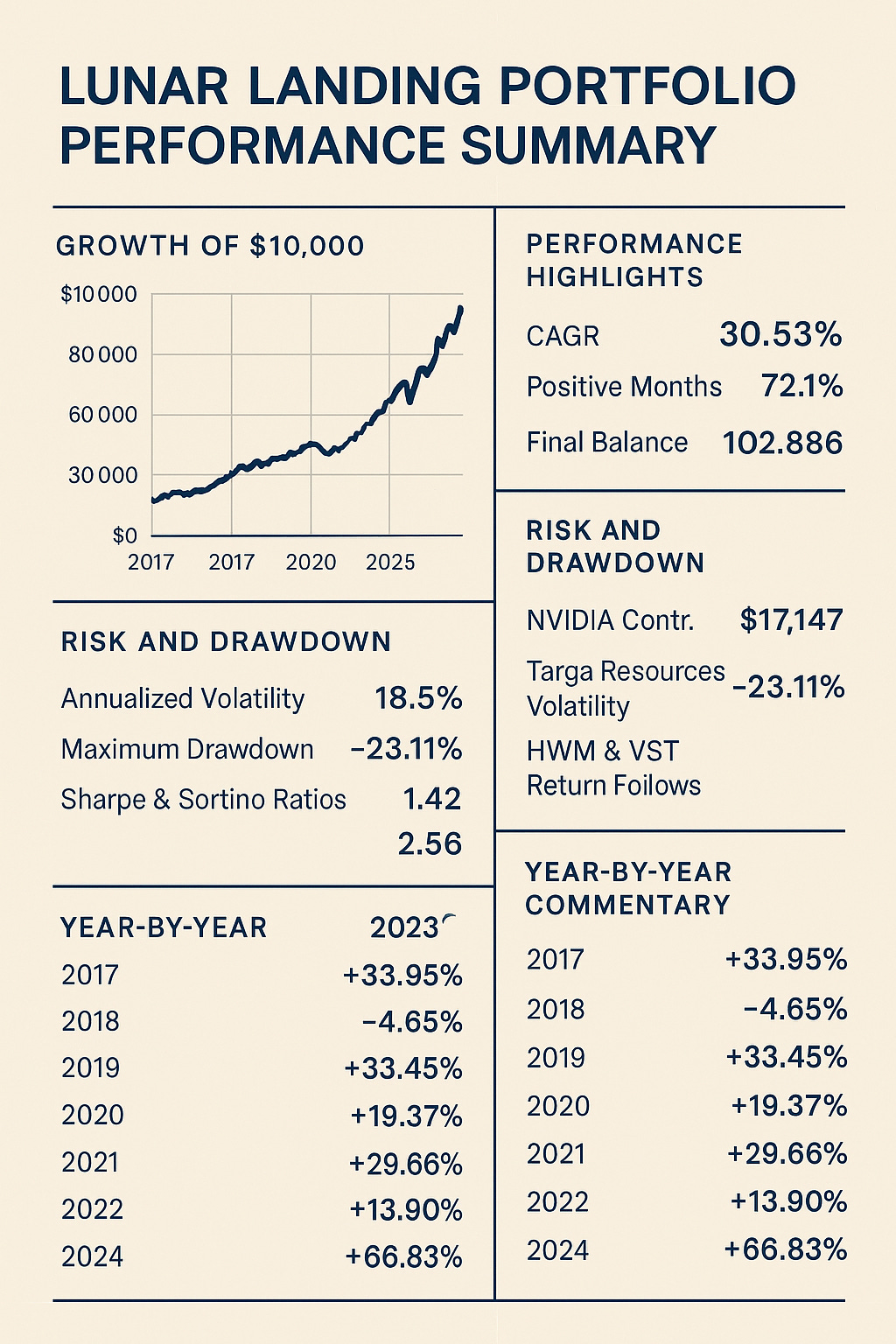

The Lunar Landing Portfolio is a disciplined blend of high-conviction U.S. equities, strategically selected for their alignment with durable growth trends, strong fundamentals, and technical leadership. Grounded in a methodology that merges macroeconomic cycles with volatility-adjusted momentum, the portfolio aims to harness both the power of innovation and the stability of institutional-grade names. A $10,000 investment at inception would now be worth over $102,000—testament to the strength of its diversified yet surgically selected holdings.

The Lunar Portfolio in Pluto’s Spotlight

Last week’s market turbulence wasn’t just a reaction to headlines—it was a revealing of power dynamics long simmering beneath the surface. As the Sun in Libra trined Pluto in Aquarius, the astrological chart aligned with a portfolio that thrives on momentum, depth, and strategic positioning. The Lunar Landing Portfolio, built to perform during cycles of transformation and emergence, rose with striking symmetry to the market’s underlying mood. Pluto’s realm—hidden forces, structural recalibrations, and systemic truth—echoed through our holdings, particularly those rooted in semiconductors, infrastructure, and energy transition, sectors where power and innovation converge.

This isn’t coincidence. With Mercury and Mars both slicing through Scorpio, the cosmos sharpened its focus on strategy and precision—traits mirrored in the portfolio’s blend of resilient cash-flow generators and innovation leaders. Amid a backdrop of geopolitical flux and data uncertainty, the Lunar Portfolio didn’t just hold steady—it extended its lead. From January 2017 through September 2025, the strategy returned 928.86%, compounding at an annualized 30.53%. In a week when markets were reactive, our methodology—disciplined, diversified, and attuned to deeper currents—proved adaptive.

This edition not only marks a continuation of strong performance but underscores a core truth of the Lunar Portfolio: when systemic shifts rise to the surface, it’s not disruption we fear—it’s the clarity we’ve been waiting for.

Dips Aren’t Destinies: Interpreting Pullbacks in a Volatile Cycle

For many investors, sharp equity declines—especially sudden ones—can trigger emotional reactions and calls for drastic portfolio shifts. But it’s essential to differentiate the nature of a dip before assigning meaning. Short-term drops in individual stocks are often driven by company-specific news: earnings misses, executive moves, or regulatory headlines. These micro-signals typically reflect transitory sentiment or narrow sector moves rather than structural portfolio threats.

Full-market pullbacks, by contrast, are more often tied to macro sentiment: shifting economic expectations, geopolitical events, or liquidity changes. When these selloffs happen quickly, they tend to reflect emotional reactions—fear-driven repositioning rather than a wholesale reevaluation of fundamentals. However, when broad corrections unfold slowly over weeks or months, they may reflect deeper structural concerns about economic health, policy missteps, or systemic tightening.

The latest FOMC minutes from September 2025 offer a clear lens into the current macro backdrop—and it’s not one of systemic breakdown. While the labor market has softened and the Fed acknowledged rising downside risks to employment, core inflation remains contained, consumption is firming, and financial conditions remain broadly supportive of growth. Treasury yields have fallen, credit markets remain orderly, and equity prices—despite recent volatility—are still near record highs.

Importantly, the Fed is not on autopilot. With inflation moderating and labor metrics mixed, the Committee lowered the federal funds rate to a range of 4–4.25% and emphasized its readiness to adjust policy responsively based on evolving data. In their own words, “monetary policy was not on a preset course,” and nearly all participants agreed that policy easing may be appropriate if downside risks persist.

In this context, market dips—especially rapid, sentiment-driven ones—are better seen as recalibrations than red flags. They reflect shifts in positioning, not permanent shifts in trajectory. For long-term portfolios like Lunar Landing, designed around secular strength and fundamental resilience, these moments are not reasons to panic—they’re confirmations that volatility is not just expected, but part of the plan.