📈 Key Investment Lessons from Buffett

Through a Market Watching the Moon Lens

📈 Key Investment Lessons from Buffett — Through a Market-Watching Lens

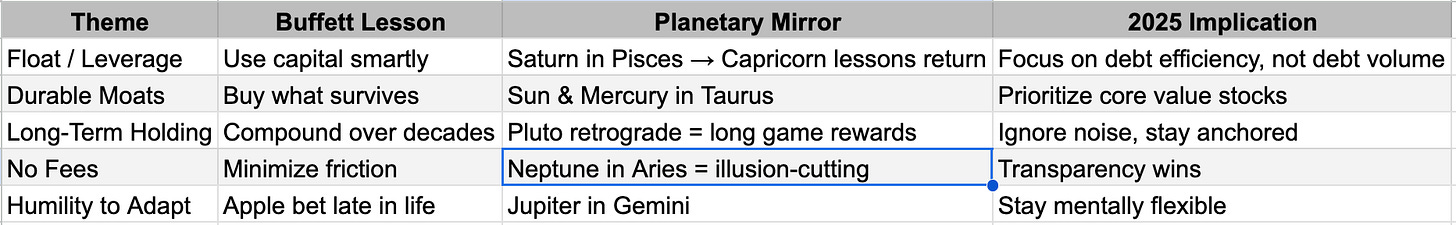

Warren Buffett’s retirement marks the end of an era. The lessons outlined in this article aren’t just timeless—they’re also especially resonant right now as we navigate a period of macroeconomic and market uncertainty. Let’s distill the key takeaways:

1. The Power of Float and Cheap Capital

Buffett’s genius wasn't just about stock-picking—it was about capital structure. Using insurance float as low-cost leverage meant Buffett could compound at outsized rates with far less downside risk. In today’s environment of rising capital costs and tighter credit, this is a potent reminder: the cost of capital is an invisible hand that can lift or sink returns.

Investor takeaway: In 2025’s climate, capital efficiency and balance sheet resilience matter more than ever.

2. Moats Matter More Than Momentum

The FlightSafety example underscores Buffett's obsession with durable competitive advantage. In an age of AI hype and speculative growth stories, the FlightSafety analogy reminds us that operational quality often wins long-term.

Investor takeaway: Focus on foundational businesses with high switching costs, trusted brands, or regulatory capture. These will hold up if markets grow more volatile later this year.

3. Infinite Holding Period = Compounding Edge

Buffett's favorite holding period is forever. As shown in the thought experiment, survivability > volatility. With elevated interest rates and slower GDP growth, long-term compounding at modest rates may outperform flashy bets.

Investor takeaway: Play the long game. This is a time for resilience, not rotation.

4. Zero Fees = Hidden Alpha

Buffett’s unique structure eliminated management fees—an invisible tax on compounding. Most investors underestimate how even a 1% fee drains long-term wealth.

Investor takeaway: Cut fees where you can. Even passive outperforms active 60%+ of the time after fees.

5. Epistemic Humility: The Apple Trade

Buffett’s Apple stake is a masterclass in evolving your edge. For someone who historically shunned tech, he recognized Apple’s consumer monopoly and pivoted late in life.

Investor takeaway: The best investors adapt. Don’t let old frameworks blind you to new realities.

🔮 Astrological Context: Buffett's Retirement Amid Taurus Stability & Piscean Closure

As of May 6–13, 2025, the cosmos echoes with symbols of legacy, recalibration, and enduring value—all archetypally aligned with Warren Buffett’s investment philosophy and his decision to step down.

🪙 Sun in Taurus (23°)

Taurus represents stability, value, and slow accumulation—an apt solar position as Buffett closes a chapter rooted in patient compounding and capital discipline. This placement underscores markets rewarding solid fundamentals and tangible assets, not hype.

Market Note: Investors may gravitate toward value sectors (energy, industrials, consumer staples) while tech recalibrates under increasing regulation and cost pressure.

💬 Mercury in Taurus (6°)

Communication and thought processes (Mercury) are grounded, methodical, and focused on financial realism. Market narratives are shifting from speculative storytelling to balance sheet clarity and margin strength.

This favors Buffett-esque companies: cash-generative, low-debt, with strong free cash flow.

🌕 Moon in Sagittarius (7°)

Emotionally, the Moon in Sagittarius seeks vision and expansion, but may gloss over details. Markets could be experiencing short-term optimism, particularly in growth sectors or international exposure.

But with Saturn at 29° Pisces (critical degree), that optimism is tempered by karmic reckonings in sectors with bloated expectations (e.g. unprofitable tech, crypto).

🔄 Saturn at 29° Pisces

The karmic taskmaster sits at the last degree of the zodiac—a point of closure, accountability, and lessons learned. This reinforces the Buffett lesson: what lasts is what compounds, not what flashes. Also suggests broader regulatory tightening and reality checks ahead.

⚡ Jupiter in Gemini (24°)

Jupiter's shift to Gemini emphasizes information, networks, and communication. This will favor nimble, adaptive investors—not necessarily the deep value cohort, but those who can read fast-moving trends with a Buffett-like discipline.

🛠️ Pluto Retrograde in Aquarius (3°)

Pluto's retrograde cycle in Aquarius brings collective power and technological reformation under review. As Buffett steps away, the market's new leadership class (like AI giants and decentralization projects) faces a test: do they have moats, or just momentum?

🧭 Final Outlook: Buffett’s Legacy, Investor Strategy, and 2025’s Cosmic Trends

📉 In short: Warren Buffett didn’t just win the market—he outlasted it. The planetary alignments now reward patience, pragmatism, and purpose. As one cycle ends (Saturn 29° Pisces), a new one begins. Investors who align with Buffett’s principles—not his portfolio—will navigate 2025 with clarity.