High-Growth Resilience: The Lunar Landing Portfolio Soars Through Volatility

Compounding in the Cosmos: A Portfolio Odyssey

As the Sun continues its transit through Leo, the Lunar Landing Portfolio aligns with an energetic climate favoring bold leadership, visionary risk-taking, and renewed momentum in growth sectors. With Mercury also retrograding through Leo, this period encourages reflection on strategic positioning while amplifying the power of clear narrative and technical edge. The Moon’s current passage through Sagittarius injects optimism and a drive toward expansion—mirroring the portfolio’s sharp upward trajectory. Jupiter in Cancer adds a protective undertone, nurturing core holdings tied to healthcare and infrastructure. Meanwhile, Pluto retrograde in Aquarius continues to rewire long-term collective systems—perfectly suited to our basket of forward-thinking, disruption-ready equities. With these planetary placements, the current cosmic backdrop supports the kind of disciplined ambition this portfolio embodies: expansive, bold, but grounded in precision.

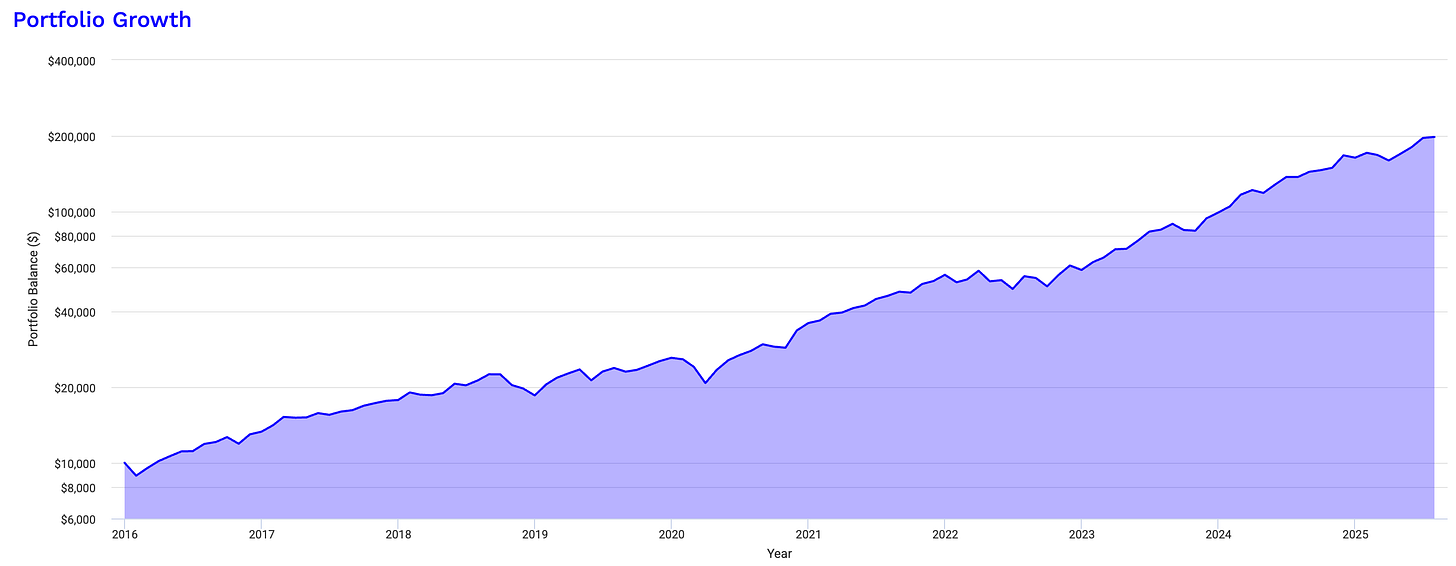

The Lunar Landing Portfolio is a handpicked collection of 15 high-conviction U.S. equities engineered to capture enduring trends in technology, infrastructure, and healthcare. Designed with an emphasis on long-term momentum, structural resilience, and astrological alignment, this portfolio reflects a disciplined commitment to riding innovation waves while managing downside risk. From January 2016 to July 2025, the strategy delivered a staggering total return of 1,879%, turning a $10,000 investment into $197,946. This translates to a compound annual growth rate (CAGR) of 36.55%—a result that underscores the strength of a curated, forward-facing equity basket operating within secular growth themes and technical leadership.