AstroAlpha: Navigating Markets with Cosmic Precision

High-Conviction Holdings Power a Meteoric Rise

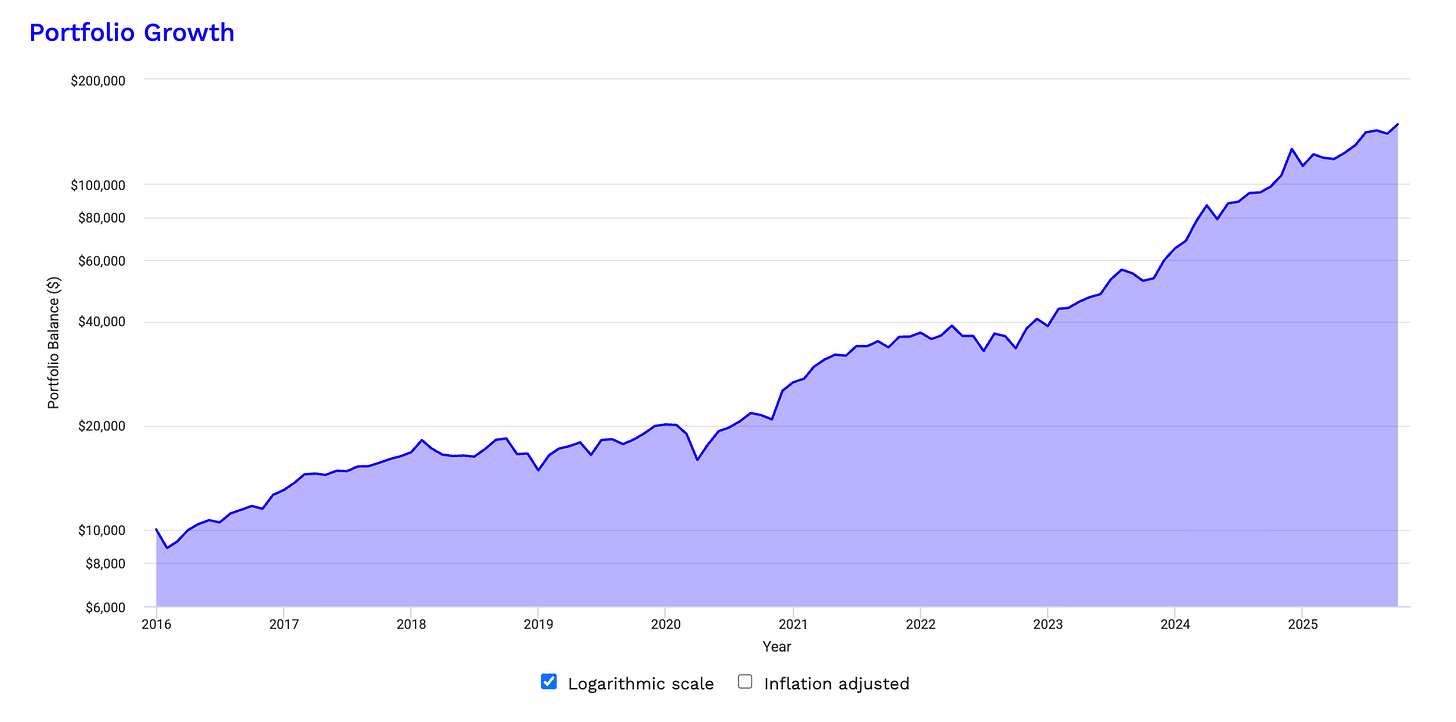

The Lunar Landing Portfolio is a curated basket of 14 high-conviction U.S. equities chosen for their alignment with secular growth trends, robust fundamentals, and technical strength. This group blends innovation, infrastructure, and financial leadership, offering investors exposure to transformative sectors while aiming for resilience during macro turbulence. Over the nearly decade-long backtest period from January 2016 through September 2025, the portfolio delivered an extraordinary annualized return of 31.88%, growing a $10,000 investment into $148,495. This performance underscores the value of disciplined equity selection and diversified exposure to high-momentum names across industries.

Scorpio Alignments and Structural Focus

As the Sun moves through early Scorpio (4°), joined by Mercury and Mars in the same sign, markets enter a phase of heightened scrutiny and structural recalibration. This astrological configuration mirrors investor sentiment: while indexes hover near record highs, conviction is giving way to selectivity. Scorpio transits often reveal what lies beneath the surface—liquidity strains, valuation extremes, or systemic imbalances—and this cycle is no exception. The Lunar Landing Portfolio, with its emphasis on durable innovation and sector balance, enters this window well-positioned for what lies ahead.

Venus in Libra trine Jupiter in Cancer offers a stabilizing influence, encouraging appetite for yield and quality income—benefiting dividend-rich sectors and bolstering market sentiment. But Venus’s approaching square to Pluto in Aquarius reminds us that overleveraged or overly speculative positions may face pressure. Uranus retrograde in Gemini adds an undercurrent of digital disruption, particularly in tech and communication assets—areas where the portfolio maintains strong exposure through names like NVIDIA and Cadence.

Meanwhile, Saturn retrograde in Pisces reinforces discipline, especially as it aligns with Neptune and blurs the line between stimulus and sustainability. Investors are navigating partially blind amid delayed data and policy ambiguity—a dynamic echoed in Neptune’s influence over narrative-driven price action. As Pluto continues its early steps through Aquarius, long-term shifts in technology, sovereignty, and digital capital flows accelerate. This broader transformation favors portfolios with clarity, balance, and forward alignment—traits embedded deeply in the Lunar Landing framework.

🧭 Portfolio Overview

NVDA – NVIDIA Corp

A leader in AI, GPUs, and semiconductor design, NVIDIA continues to ride the explosive demand for accelerated computing. Its presence in the portfolio reflects a strong commitment to innovation at the frontier of technology.

MSTR – MicroStrategy Inc.

As a flagship player in enterprise analytics and digital asset strategy, MicroStrategy offers unique exposure to both cloud-based business intelligence and the Bitcoin macro-cycle. Its high volatility is counterbalanced by its massive upside.

TRGP – Targa Resources Corp

A key beneficiary of U.S. energy infrastructure growth, Targa plays a crucial role in the midstream oil and gas supply chain. It supports the portfolio’s balance with exposure to real-asset backed cash flows and commodity cycles.

HWM – Howmet Aerospace Inc

Riding the upcycle in aerospace and industrial manufacturing, Howmet adds exposure to high-performance engineered products. It supports macro themes of global reindustrialization and defense modernization.

IBM – International Business Machines Corp.

Anchoring the portfolio with a legacy name, IBM provides exposure to enterprise IT and hybrid cloud. While its growth is more muted, its dividend yield and stability reduce downside risk.

AXP – American Express Co.

A stalwart in consumer credit and financial services, American Express benefits from economic expansion and rising interest rate cycles. Its role in the portfolio adds resilience during inflationary regimes.

GS – Goldman Sachs Group, Inc.

Goldman Sachs stands at the crossroads of capital markets, M&A, and asset management. Its inclusion strengthens the portfolio’s access to financial sector alpha and pro-cyclical tailwinds.

CAH – Cardinal Health, Inc.

Cardinal Health provides pharmaceutical distribution and services—an often overlooked but critical backbone of the healthcare system. Its defensive nature enhances risk-adjusted returns.

APH – Amphenol Corp.

A global supplier of interconnect products, Amphenol thrives in the connectivity age, from automotive electronics to advanced sensors. It is a quiet compounder in the industrial tech space.

COR – Cencora Inc.

Formerly AmerisourceBergen, Cencora supports healthcare logistics and distribution. Its steady returns and low correlation to tech add ballast during periods of market turbulence.

CAT – Caterpillar Inc.

A heavyweight in construction and machinery, Caterpillar captures the global infrastructure narrative. It aligns with fiscal stimulus cycles and long-duration industrial projects.

ORLY – O’Reilly Automotive, Inc.

As a consistent performer in auto parts retail, O’Reilly benefits from aging vehicle fleets and DIY trends. It provides consumer cyclical exposure without the volatility of discretionary retail.

VRTX – Vertex Pharmaceuticals, Inc.

A leader in rare disease therapeutics, Vertex adds exposure to biotech innovation with a focus on transformative, high-margin treatments. Though volatile, it offers asymmetric return potential.

CDNS – Cadence Design Systems, Inc.

A critical enabler of semiconductor design, Cadence occupies a powerful niche in the EDA (electronic design automation) space. It supports the structural AI and chip design megatrend.

📈 Performance Highlights

From 2016 to September 2025, the Lunar Landing Portfolio produced a cumulative return of 1,384.95%, translating to a compound annual growth rate (CAGR) of 31.88%. Over 70% of months were positive (83 out of 117), highlighting consistent momentum. The best year was 2024, returning an astronomical 73.09%, buoyed by breakout performance from NVIDIA and MicroStrategy. Even during its worst year in 2018, the portfolio’s loss was limited to -11.30%, showcasing commendable downside control in volatile periods.

💥 Risk and Drawdown

Despite its high-growth orientation, the portfolio demonstrated a disciplined risk profile. The standard deviation clocked in at 21.53%, with a maximum drawdown of -21.11% during the COVID-19 market shock in early 2020. Importantly, the portfolio recovered within four months, affirming its structural resilience. The Sharpe Ratio of 1.31 and Sortino Ratio of 2.42 underscore its strong risk-adjusted performance, with a Calmar Ratio of 6.02 pointing to excellent reward per unit of drawdown. The beta of 1.20 and alpha of 12.67% reflect meaningful outperformance against the market benchmark.

📊 Return and Risk Attribution

On the return side, MicroStrategy ($28,254) and NVIDIA ($23,333) led contributions, reflecting their explosive appreciation over the cycle. Other top contributors included Howmet ($13,611) and Amphenol ($10,616). Importantly, no single holding dominated the risk profile. While MicroStrategy accounted for 18.90% of portfolio risk, the remaining names contributed in a balanced fashion—most in the 3–9% range—helping maintain overall diversification.

📅 Year-by-Year Commentary

The early years (2016–2019) established a solid foundation, with annual returns between 28% and 36%, powered by early breakouts in NVIDIA and Caterpillar. The 2020 pandemic-induced drawdown was sharp but short-lived, followed by a 32.47% rebound. From 2021 onward, the portfolio entered a high-growth phase: 39.11% in 2021, 67.89% in 2023, and the peak 73.09% in 2024. Even in 2022, a challenging macro year, the portfolio eked out a 4.43% gain—testament to the strategy’s adaptive strength.

🧠 Strategic Insights

The portfolio’s equal-weighted construction ensures each position contributes meaningfully to performance while avoiding overconcentration. Sector exposure is thoughtfully diversified: semiconductors, software, energy, industrials, financials, and healthcare all play pivotal roles. The inclusion of high-beta and high-alpha names like MicroStrategy is counterbalanced by steady compounders like Cencora and Cardinal Health. This balance enables the portfolio to capture upside in bull markets while limiting volatility during downturns. Many holdings also ride long-term megatrends—from AI and automation to energy transition and healthcare modernization.

🔍 Methodology

This portfolio was backtested using Portfolio Visualizer, with dividends reinvested and annual rebalancing applied. The selection reflects a disciplined process emphasizing technical strength, macro alignment, and risk-adjusted momentum. Historical performance data is used solely for illustrative purposes and does not guarantee future results.

🏁 Conclusion

The Lunar Landing Portfolio exemplifies the power of conviction-led diversification. By blending breakout innovators with resilient operators across sectors, the portfolio achieved stellar long-term returns with managed drawdowns. Its ability to thrive through both macro crises and market rallies showcases a blueprint for high-performance equity investing rooted in both strategy and structure. For investors seeking growth without unchecked volatility, this portfolio model delivers both ambition and balance.